George F. Librizzi

Municipal Assessor

glibrizzi@veronanj.org

Peter Mouskourie, CTA, SCGREA

Assistant Tax Assessor

pmouskourie@veronanj.org

Municipal Assessor

About:

The Municipal Assessor’s office is responsible for the establishment and maintenance of real property values within the city. All values are determined by inspection of the site in question and established per rules set forth by the State of New Jersey.

The annual property assessment cards (white postcards) are mailed out at the end of January each year from a private vendor. This notice is to advise residents what their current assessment is and should not be used for income tax purposes. The tax bill is what should be used when filing income taxes for the proper tax year figure.

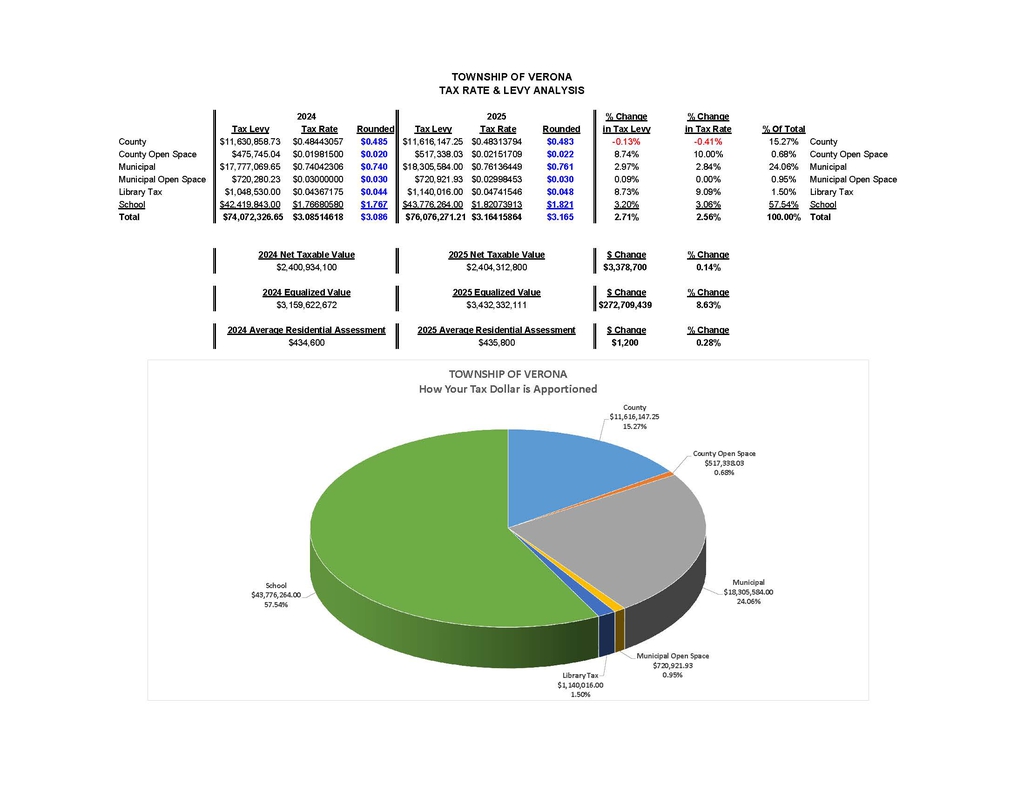

Certified 2025 Tax Rate is: 3.165 and the 2025 Tax Ratio is 70.19% Tax Rate & Levy Analysis

For tax billing and payment information, contact the Tax Collector's Office at 973-857-4777